MUSIC + CULTURE

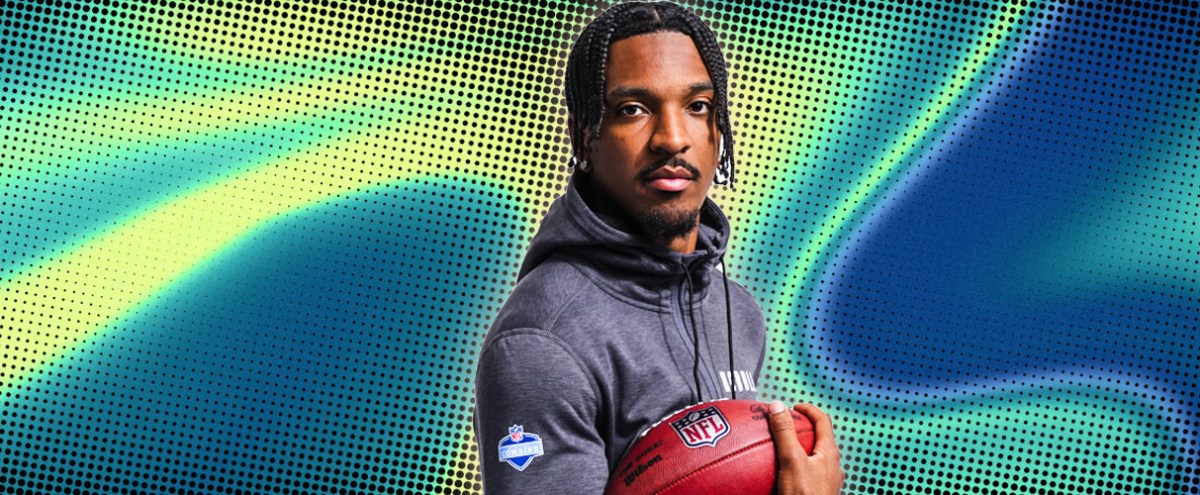

NEW + NOTEWORTHY

The Latest

Featured

UPROXX SHOWS

WATCH NOW

WATCH NOW

Watch Next

We Live For Music

The Best Of Streaming

Styles Of The Times

As The NBA Turns

The Latest